According to the data of the Asset Management Association of China (AMAC), 66,418 private equity (PE) funds have been filed with the AMAC as of the end of 2017, growing by 42.82% on a year-over-year basis. Increasingly perceived as providing greater value than merely being an asset management vehicle, PE funds are being used more and more as viable investment tools by other financial products. This article will focus on discussing how PE funds are used as investment tools by quasi-real estate investment trusts (quasi-REITs).

THOMAS WANG

邦信阳中建中汇律师事务所合伙人

Partner

Boss & Young

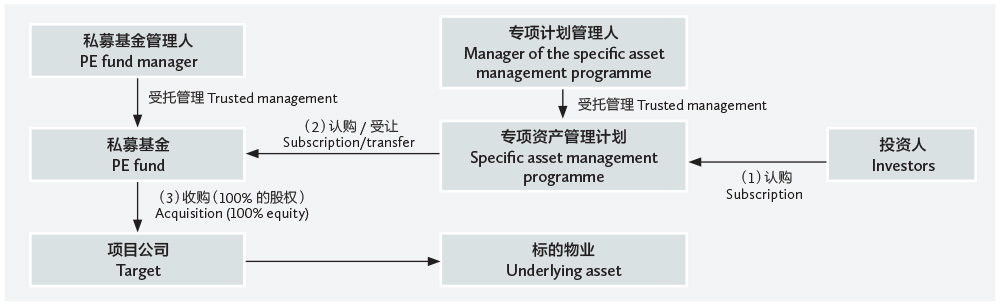

Quasi-REITs structured with reference to fundamental elements of REITs have become an important force of the asset securitization sector in China. For the purpose of this article, a quasi-REIT is an asset-backed security (ABS) programme filed with the AMAC and listed on an exchange, which is collateralized by a pool of existing properties benefiting from steady cash flow. Usually a quasi-REIT is structured in such a manner that stakes in the invested companies are held through a PE fund (please see the chart in this column for a detailed structure).

Considerations for embedding a quasi-REIT into a PE fund. There is an argument that quasi-REITs are embedded into PE funds particularly to facilitate collateral registration, public offerings, control of underlying assets, and transfer and liquidation of shares. However, the author has reservations about this opinion, given the fact that the PE funds into which quasi-REITs are embedded are often contractual funds. Instead, the author is more of the opinion that the design takes risk segregation, tax implications and restructuring of underlying assets into consideration.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Thomas Wang is a partner and Li Zhiqi is an associate at Boss & Young

中国上海市黄浦区中山南路100号

金外滩国际广场12-15楼 邮编:200010

12/F-15/F, 100 Bund Square

100 South Zhongshan Road

Huangpu District, Shanghai 200010, China

电话 Tel: +86 21 2316 9090

传真 Fax: +86 21 2316 9000

电子邮箱 E-mail:

thomas_wang@boss-young.com

lizhiqi@boss-young.com