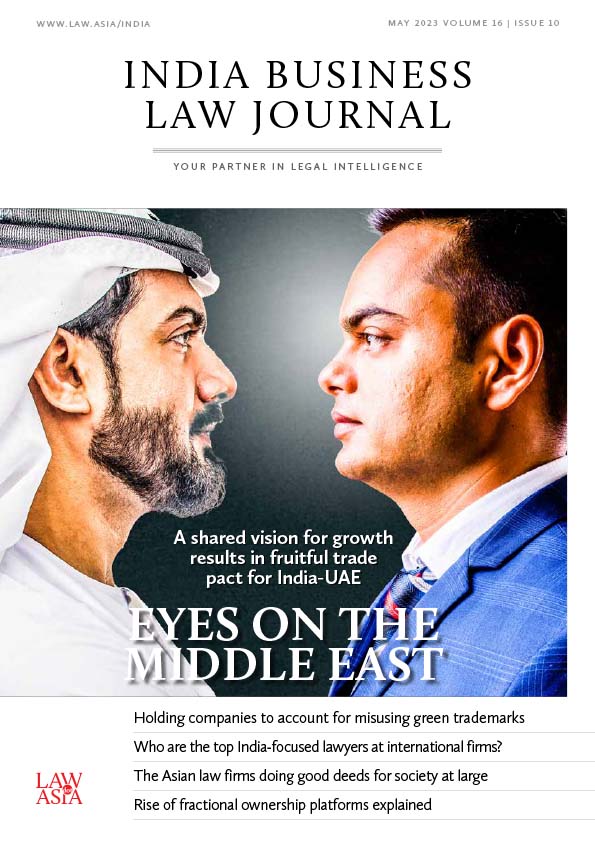

In an exclusive interview, Sadaff Habib, a Dubai-based independent arbitrator and founder of Equanimity Arbitration, speaks to China Business Law Journal about the status of the local arbitration system, common challenges awaiting Chinese parties, and how the element of culture factors into the equation

Although international trade of late has been characterised by restrictions, sanctions and decoupling, the trade relationship between China and the United Arab Emirates (UAE) has only grown stronger. For years, China has been the UAE’s largest trading partner, and the UAE has been China’s largest export market and second-largest trading partner in the Middle East.

These facts have not escaped Chinese companies eyeing opportunities abroad, but with more opportunities also come more disputes. And when these disputes arise in the Middle East, can Chinese and other foreign parties expect their legitimate rights and interests to be protected? Additionally, what can they do to improve their chances?

Sadaff Habib, a Dubai-based arbitrator and founder of Equanimity Arbitration, offers some answers.

China Business Law Journal: When foreign companies enter a contract with a UAE or Middle Eastern party, what are the top concerns for their in-house counsel in terms of dispute resolution?

Sadaff Habib: I have spent some time working in-house, and during my career I’ve had a lot of interaction with in-house counsel. The key concern for in-house counsel, or even for a business, would be: I’m entering into this contract containing an arbitration agreement. If things turn sour, can I actually bring a dispute? And what would happen when a dispute arises?

Now, let’s assume that our arbitration agreement refers to Dubai as the seat of arbitration, and that it is under the DIFC-LCIA [Dubai International Financial Centre and London Court of International Arbitration] rules. Let’s assume, for example, it is an arbitration agreement that was entered into, say, four years ago. But three years ago, a decree was issued to dissolve the DIFC-LCIA Arbitration Centre and the Emirates Maritime Arbitration Centre (EMAC).

A lot of times, what happens is that this becomes an enforceability issue. The party, especially the party against whom the award is issued, might raise this at the time of enforcement and say: ‘But the institution doesn’t exist anymore.’

They might argue that the award should be set aside. However, the cases that were handled by the DIFC-LCIA were moved to the Dubai International Arbitration Centre (DIAC), which became our main arbitration centre.

What I have seen over the past three years is that the DIAC has really bolstered its case management team, including the registrar. They have a strong team on the ground now. In terms of their rules, which were also revamped, they have made significant improvements.

But back to our scenario. The DIFC-LCIA Arbitration Centre does not exist anymore. So, in that case, the party would take their dispute to the DIAC.

The question of validity then arises. Now we go back to the seat of arbitration, which is Dubai. Like any other jurisdiction, there are certain nuances that in-house counsel, or even external counsel, would need to be aware of.

For example, things like signing on every page of the arbitral award. That is a requirement under Dubai’s civil law jurisdiction. These kinds of procedural details can come up, but they are manageable.

The main point here is how the award is treated by the courts. There was a concern recently when an award was set aside by, I think, a US District Court judge last year because of this very issue. However, recent judgments in Dubai, as well as from the Abu Dhabi Court of Appeal and the Dubai International Financial Centre (DIFC) courts themselves, have confirmed the application of the decree. They have recognised that it is still a valid arbitration agreement and that disputes can validly be referred to the DIAC.

Now, let’s look at another situation involving a Chinese party and a local UAE party, both based in the UAE. It is very common in such cases for the arbitration agreement to refer to the DIAC, with the seat of arbitration being the DIFC. This is different from our first scenario, where we had Dubai as the seat of arbitration and the DIFC-LCIA as the arbitration centre.

The seat of arbitration is extremely important because it determines which courts will exercise supervisory powers. For example, if you needed an interim measure, say, an attachment order on assets, you would go to the courts at the seat of arbitration.

When the decree came out three years ago, it was followed by amendments to the DIAC rules in 2022, which would apply to this scenario. Under these rules, the DIFC is the default seat.

Now, there is a difference between having the DIFC as the seat and having Dubai as the seat. I think this is beneficial for parties to understand because the DIFC is a common law jurisdiction, an offshore jurisdiction within the UAE that operates under a common law system.

This can be beneficial for parties from common law jurisdictions like Hong Kong. Having the DIFC as the seat might give them more comfort because the courts operate in a way that is more familiar to them, similar to how things work in Hong Kong.

CBLJ: What is your experience with disputes involving Chinese parties? Have you noticed any characteristics unique to them?

Habib: One interesting case I was involved in was an ICC arbitration between a Chinese contractor and a local subcontractor. The seat of arbitration was Dubai.

I have noticed a cultural element that often comes into play. Chinese parties might not want to go through full-blown arbitration. Instead, they often prefer to settle the matter. They lean towards having discussions and resolving the issue through negotiation rather than arbitration.

That is exactly what happened in this case. We started the proceedings, we filed a request for arbitration, and the other party submitted their answer. But, at the same time, they were having discussions in parallel with the local subcontractor. Eventually, they settled the matter outside of arbitration.

I think it is a good thing. It reflects a preference for efficiency and maintaining business relationships.

The one thing I did notice was that during the negotiations I sensed a bit of a disconnect in communication, a disconnect in terms of how the Chinese contractor was negotiating and how their approach was being received by the local subcontractor.

For example, when the Chinese contractor made a proposal, it would sometimes be taken as aggressive, even when it wasn’t intended to be so. Similarly, when the local subcontractor would make a counterproposal, the Chinese contractor would perceive it as being too direct or abrupt.

When it comes to the arbitration itself, it is difficult to say there was anything unique because the Chinese party had engaged a law firm here in Dubai. In terms of the submissions, they were exactly what you would expect from an international law firm, thorough and aligned with international standards.

CBLJ: For Chinese companies looking to expand their business in Dubai, what can they expect from it as the seat of arbitration, especially compared with more familiar arbitration centres in mainland China, Hong Kong and Singapore?

Habib: If they choose Dubai as the seat of arbitration, they need to understand that it operates under civil law, which is different from the common law jurisdictions they might be used to working in.

We also need to distinguish between the seat of arbitration and the governing law of the contract. What I have seen in such scenarios is that, to keep things neutral, the parties might choose the governing law of England and Wales. Since it is a common law system, it is often acceptable to both parties and serves as a compromise.

However, a lot of thought needs to go into this, not just about picking a jurisdiction, but also about understanding if the governing law is truly what you want your contract to be bound by.

Now, coming back to the seat, what I have observed is that while Dubai is frequently selected as the seat of arbitration, it is actually more common to have the DIFC as the seat. This is because the DIFC operates under a common law system, which makes it a friendlier option — a fair compromise between the parties.

For Chinese businesses entering the UAE, especially if they have an arbitration agreement, there is definitely a process of understanding involved. However, it is worth noting that the UAE has grown significantly as an arbitration-friendly jurisdiction.

Starting arbitration now, with Dubai or the DIFC as the seat — is very different from how it was even three to five years ago. The local courts have become more open to arbitration and are more willing to uphold arbitration agreements.

I think these developments should give Chinese parties some comfort. Even though the jurisdiction might be unfamiliar and quite different from what they’re used to, if we look at how the courts have been managing arbitration awards, there is reassurance. Party autonomy is respected, and arbitration agreements, if they meet certain criteria, will be upheld.

CBLJ: Have you observed any common challenges that Chinese businesses face in terms of arbitration with Dubai or the DIFC?

Habib: Yes, absolutely. From a business perspective, Chinese parties are entering a very different environment, both in terms of jurisdiction and business culture. So there is naturally a degree of uncertainty and risk.

One thing I have realised is that Chinese parties often struggle with identifying the right lawyers. They often ask questions like: ‘Who should we use? What’s their classification? Who’s the right person to speak to for, say, a construction dispute or a shareholder dispute?’

I feel there is a gap that needs to be bridged in terms of connecting Chinese parties with the right legal professionals.

Another challenge is fee arrangements. Chinese parties might be used to a particular fee structure with their lawyers back home. However, when they engage UAE-based lawyers, they encounter different fee structures, engagement practices and cultures around letters of engagement.

These differences can create some friction or uncertainty. So, I think there is a need for better communication and understanding in this area, ensuring that Chinese businesses are paired with the right lawyers for their cases.

CBLJ: In terms of dispute resolution, what advice would you give Chinese companies that wish to trade with UAE parties or to expand their presence in the region?

Habib: I have noticed this not just with Chinese parties, but generally across the board, that when parties are negotiating a contract, they often don’t give much thought to the arbitration agreement.

It is something they tend to overlook because they are so focused on the financial terms, the scope of work and everything else. Everything seems fine at the start — everything is rainbows and roses, so to speak — but they forget that if a dispute arises, they’ll have to rely on the dispute resolution clause.

My first tip would be: give proper thought to your arbitration agreement. Look at it carefully. Think about the seat of arbitration and the institution you want to use.

For example, in cases I have seen involving Chinese parties and UAE or Middle Eastern parties, they often end up agreeing to ICC arbitration. In these cases, the ICC might be the institution, and the seat could be Dubai, the DIFC, or even Hong Kong.

Now, let’s say the parties agree that Dubai or the DIFC will be the seat, and the DIAC will be the institution. That is fine. But be mindful of the lawyers you choose when you go into a dispute.

Arbitration lawyers are different from transactional lawyers. You might have used a certain lawyer to draft your contract, but they are focused on contractual advice and drafting. When you go into arbitration, you need an arbitration specialist. That distinction is crucial.

So, my second tip would be: work with an arbitration lawyer, not your transactional lawyer.

My third tip would be: if you want better control over the arbitration process, consider having a three-member tribunal instead of a sole arbitrator.

With a three-member tribunal, each party can nominate their own co-arbitrator, who is then ultimately appointed by the institution. This gives you some degree of control over who will be on the tribunal and involved in the decision-making process. The two co-arbitrators will then nominate the chair, and once the chair is appointed, the tribunal is constituted.

Another piece of advice I would give is: specify the language of arbitration. Don’t leave it open-ended. Consider specifying English as the arbitration language because it is often the neutral choice.

Be mindful of the seat of arbitration because the local courts of that seat will have supervisory powers over the arbitration. The seat is very important. And definitely don’t leave your arbitration agreement to the last minute.

There is one more point I would like to add. Since there is a lot of construction taking place, and because Chinese contractors are heavily involved in such projects, for Chinese parties I highly recommend carefully choosing your experts in construction arbitration.

For example, if you’re making a claim for delay, a quantum claim or addressing defects, be very careful about how you choose your experts. These experts will be writing reports and presenting them during the arbitration.

This will be a key component of your construction dispute.

CBLJ: Is Sharia law prevalent in the Middle East, and might it discourage Chinese parties from investing in the region?

Habib: Yes and no. Historically, Sharia law was a part of the UAE’s legal system, but it has evolved into more of a civil law jurisdiction, heavily influenced by the French Civil Code and the Egyptian Civil Code.

Saudi Arabia, on the other hand, remains Sharia law-based. For instance, if a party claims interest in a contract governed by Saudi law, that claim may not be recognised because it could be seen to violate public policy under Sharia law.

So, you need to be careful and mindful when dealing with contracts governed by Saudi law.

But there are ways to address these challenges. For example, during negotiations, the parties may choose to agree to a different governing law. They could also decide to have a neutral seat for arbitration, such as Dubai.

So, while Saudi Arabia’s legal system might create some uncertainty, I wouldn’t say it is a deterrent. Businesses just need to carefully consider their options and address these factors during negotiations.

CBLJ: Many international arbitral institutions are working to improve their diversity in the panel of arbitrators, and across many aspects of arbitration, even reflecting this in their rules and practices. Do you see similar trends in the DIAC and other local dispute-related agencies?

Habib: That’s a very important issue. I would say definitely, yes. If we look at the general makeup of arbitrators 10 years ago compared to today, they wouldn’t look like me. Back then, you would typically see a white Englishman, quite senior, and you could even say there was a ‘typical profile’ for arbitrators.

But things have definitely changed. I think it is also thanks to initiatives addressing these issues that have pushed institutions to ensure there is a more diverse pool of arbitrators and experts.

Counsel have also become more diverse. They now come from different multicultural backgrounds. For example, during Dubai Arbitration Week, I’m moderating a session, and on the panel we have five speakers from different nationalities and backgrounds.

You can see that the makeup of the key players in arbitration — be it arbitrators, counsel or experts — has really evolved to reflect what ‘international arbitration’ should mean. Arbitration is now a true representation of the diversity of people involved in the process.

I think this gives more confidence to the market and to businesses. It shows them that they can find someone who resonates with their culture and understands their concerns.

This is such an important consideration. When choosing an arbitrator or lawyer, you should ask yourself: Does this person understand the culture I come from? Culture translates into communication, and effective communication is key to achieving an efficient and effective arbitration process.

It is not just about knowing the law or having technical expertise. The soft skills are equally critical. You’d be surprised; even if the process has been efficient up to a point, the tribunal deliberations can sometimes get derailed. If an arbitrator lets their ego interfere with the process, it can prolong deliberations unnecessarily.

This ultimately delays the outcome, and that means delaying the final award for the parties involved. And, as we all know, time is money.