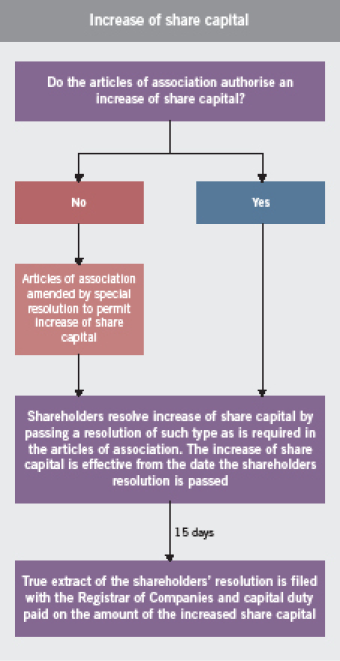

An increase of authorised share capital comprises one of five capital operations listed in section 60 of the Companies Law, which may be exercised by a company limited by shares “if so authorised by its articles”. Where the articles of association of such a company do not expressly contain an authority to increase share capital, they would need to be amended by special resolution to facilitate such authority for the increase to be effected. An increase of capital requires the approval of the company’s shareholders and is effective from the date such shareholder resolution is passed. In the absence of an express requirement in the Companies Law, the type of shareholder resolution required – ordinary or special – is a matter of the construction of the articles of association of each company.

L. Papaphilippou & Co

Advocate

L. Papaphilippou & Co

Cyprus

Pursuant to section 62(1) of the Companies Law, the shareholders’ resolution authorising the increase of capital would need to be filed with the Registrar of Companies within 15 days from the date the resolution is passed. In practice, the company secretary submits a certified true extract of the shareholders’ resolution authorising the increase of capital to the Registrar of Companies, along with Form HE14, which sets out numerically the increase of share capital for the purposes of calculation of the capital duty due. Capital duty is calculated at a rate of 0.6% on the amount of the share capital increase or €20 (US$27), whichever amount is greater, and is payable at the time all filings pertinent to the increase of share capital are submitted to the Registrar of Companies.

Subject to confirmation by the court, a company limited by shares may by special resolution, and if authorised by its articles, reduce its authorised share capital in any way. Where the articles of association of such a company do not expressly contain an authority to reduce share capital, they would need to be amended by special resolution to facilitate such authority for the reduction to be effected. The rationale behind the sanction of the court is to ensure that the proposed reduction of share capital is fair and equitable, not only among the shareholders of the company, but among any other interests dealing with the company.

Subject to confirmation by the court, a company limited by shares may by special resolution, and if authorised by its articles, reduce its authorised share capital in any way. Where the articles of association of such a company do not expressly contain an authority to reduce share capital, they would need to be amended by special resolution to facilitate such authority for the reduction to be effected. The rationale behind the sanction of the court is to ensure that the proposed reduction of share capital is fair and equitable, not only among the shareholders of the company, but among any other interests dealing with the company.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Nick Tsilimidos is an advocate at L Papaphilippou & Co in Cyprus

17 Ifigenias street

2007 Strovolos, P.O. Box 28541

2080 Nicosia, Cyprus

电话 Tel:+357 22 27 10 00

传真 Fax:+357 22 27 11 11

电子邮件 E-mail:nt@papaphilippou.eu

www.papaphilippou.eu