The Reserve Bank of India (RBI) recently amended the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations 2000 (FEMA Regulation) with respect to the issue price for a preferential issue of shares by unlisted companies in India. The amendment came into effect on 21 April.

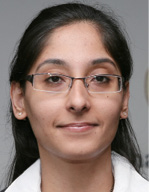

Senior associate

Amarchand &

Mangaldas &

Suresh A Shroff & Co

In terms of the amendment the minimum issue price for a preferential issue of shares should be the higher of (i) the fair valuation of shares computed by a chartered accountant or a Category I Merchant Banker registered with the Securities and Exchange Board of India (SEBI) in accordance with the discounted free cash flow (DCF) method and (ii) the price applicable to transfer of shares from residents to non-residents in accordance with the pricing guidelines issued by the RBI from time to time.

Until now, shares of unlisted companies transferred to non-residents were priced according to the guidelines issued by the erstwhile Controller of Capital Issues (CCI). However, the revised pricing guidelines for the transfer of shares, preference shares and convertible debentures issued by the RBI on 4 May, does away with the need for two valuations for preferential issues by unlisted companies and introduces the DCF method in place of the CCI guidelines.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

Pooja Ramchandani is a senior associate at Amarchand & Mangaldas & Suresh A Shroff Co.

Amarchand Towers

216 Okhla Industrial Estate – Phase III

New Delhi – 110 020

Tel: +91 11 2692 0500

Fax: +91 11 2692 4900

Email: shardul.shroff@amarchand.com