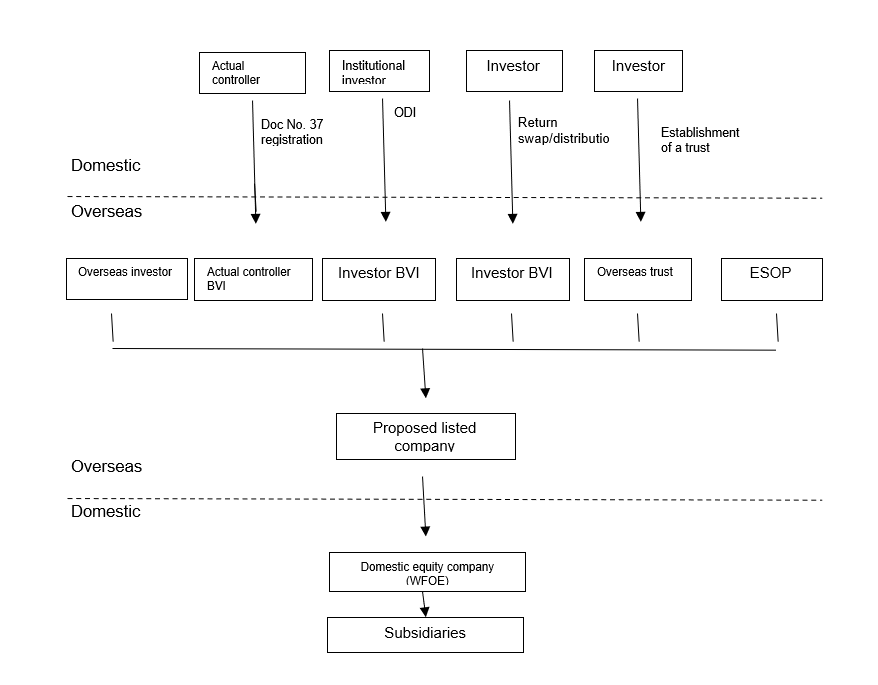

The majority of mainland Chinese mainland companies opt to list shares overseas by using a red-chip structure – that is, one in which, say, a Cayman Islands firm will serve as the publicly traded entity and the original domestic shareholder will, by various means, use that vehicle to hold their interests. How a domestic investor lawfully holds its interests in the proposed listed company, therefore, becomes a key issue.

Most red-chip enterprises choose to list on one or more of three overseas markets – the Nasdaq, New York Stock Exchange, or Stock Exchange of Hong Kong.

The possible means open to domestic shareholders to hold interests in proposed listed companies that are recognised by these foreign exchanges include: overseas direct investment (ODI); registration under the Notice of the State Administration of Foreign Exchange on Relevant Issues concerning Foreign Exchange Administration for Domestic Residents to Engage in Financing and in Return Investment via Overseas Special Purpose Companies (Doc No. 37); return swaps/distributions; and the establishment of trusts.

Overseas direct investment

This applies only to domestic institutional investors. With ODI, a domestic institutional investor invests in and holds interests in the proposed listed company overseas either directly or through a special purpose vehicle (SPV). A domestic institutional investor must carry out the approval/recordal procedures required by the development and reform commission and the commerce authority determined by its investment sector, region, amount to be invested, etc., as well as foreign exchange registration procedures.

The biggest advantage of the ODI route is its solid conformity and compliance with China’s regulations on foreign investment. Funds can be lawfully wired abroad at the time of investment, and future returns will be lawfully repatriated. The primary downside of ODI is that it heavily relies on the administrative process, leaving it uncertain as to whether approval can be secured and the time required for such approval. This could affect the timetable for establishing the red-chip structure, or even delay listing.

Doc No. 37 registration

Partner

East & Concord Partners

This is normally aimed at domestic natural persons. Through Doc No. 37 registration, a domestic resident, for investment or financing purposes, establishes or indirectly controls an SPV (i.e. the proposed listed company) overseas using his/her lawfully held assets or interests in a domestic enterprise, or using his/her lawfully held offshore assets or interests. The proposed listed company acquires or controls by way of an agreement (a variable interest entity, or VIE) the Chinese enterprise formerly owned by the domestic resident through a domestic equity company (a wholly foreign owned entity, or WFOE) established in China.

Similar to ODI, Doc No. 37 registration is compliant, and future offshore dividends or proceeds from selling the shares held in the listed company that are derived by the domestic resident can be lawfully repatriated to China. However, there are practical limitations in that Doc No. 37 registration usually requires that the “domestic resident” be the founder of the enterprise, which makes it almost impossible for non-founders to take this route. Also, not that many cities are able to carry out Doc No. 37 registration.

Return swap/distribution

Under this arrangement, a third party holds the shares of the proposed listed company, instead of the domestic investor. Any overseas returns obtained by the third party will be distributed to the domestic investor in the form of a return swap/distribution.

Return swap/distribution opens the gate for investors unable to adopt the more compliant means of ODI or Doc No. 37 registration. The downside lies obviously in its weaker compliance, the impossibility of sending funds abroad at the time of investment, and the impossibility of repatriating investment returns in the future. As the investor does obtain shares, but only the right to a distribution of the returns derived by the third party from its investment in the proposed listed company, investor rights protection is relatively weak. And that means greater investment risk.

Trusts

A domestic investor establishes a trust overseas to hold the shares of the proposed listed company, with the investor as the beneficiary. Pursuant to Doc No. 37, a trust also constitutes a form of “control” but, in practice, there are obstacles that make the carrying out of Doc No. 37 registration difficult for trusts. Fortunately, the foreign exchanges recognise trusts that have not carried out Doc No. 37 registration as being eligible to become shareholders of the proposed listed companies.

The option of establishing a trust likewise makes it possible for those unable to opt for a more compliant route to invest in the proposed listed company. Furthermore, some investors may also favour trusts from a wealth management or tax planning standpoint. However, trusts also suffer from weaker compliance and difficulties in the cross-border flow of funds.

Huang Peng is a partner at East & Concord Partners

East & Concord Partners

Suite 29/F Hongcheng International Plaza, 358-396 Juyuan Road, Hangzhou, 310020, P. R. China, P.R.China

Tel: +86571 8501 7011

Fax: +86571 5801 7085

E-mail: