Accusations of corporate irresponsibility can be extremely damaging. What steps can businesses take to ensure good corporate citizenship in India and what are the legal and financial consequences if they fail?

Ben Frumin reports

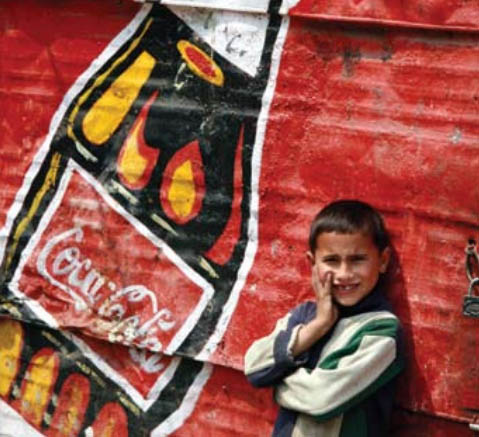

Coca-Cola’s expansion in India was hailed as one of the company’s most promising longterm strategies. It successfully acquired leading Indian brands such as Limca and Thums-Up, the country’s best-selling cola product, and by many accounts India was Coca-Cola’s fastest-growing market.

But then, all of a sudden, things went wrong. Coca-Cola was struck by a flurry of damaging accusations of irresponsible and dangerous behaviour. The company’s largest plant, in the southern state of Kerala, was allegedly draining water that fed nearby wells, putting farmers out of business. “The entire region, which was once thriving agricultural land, had come to rely on water supplied by tankers,” says Bhumesh Verma, a partner at Khaitan & Co.

There were also allegations that the land around the Kerala plant was contaminated. A 2006 study from the New Delhi Centre for Science and Environment claimed pesticide residues found in Coca-Cola and PepsiCo products were two dozen times higher than Indian safety standards allowed. Verma notes that the findings appeared to reveal that Coca-Cola products “contained pesticide residues, including chemicals which can cause cancer, damage the nervous and reproductive systems, and reduce bone mineral density”.

Both cola giants strongly denied the charges, but from a business standpoint the damage had already been done. “India received immediate international attention with the high degree of public protests against the Coca-Cola plant in Kerala,” says Verma. Kerala subsequently banned the two cola companies from making or selling their products in the state and partial bans were also adopted in other Indian states.

“Coca-Cola and Pepsi came close to being compelled to shut down [their] Indian operations,” says Vijaya Sampath, group general counsel and company secretary at Bharti Enterprises. “The companies faced suits in courts and also huge declines in sales.”

Consumer backlash

“The [Coca-Cola] case clearly demonstrates that the public can respond and protest against [the] irresponsible behaviour of corporates,” says Verma. “The bad publicity and loss of brand value had repercussions in the global market.”

“It did have a huge impact on their businesses,” agrees Ketan Kothari, a partner at Mumbai-based law firm Thakker & Thakker, noting that it’s still unclear which, if any, of the allegations against Coca-Cola and other softdrink makers were true. “The matter did die down, but during that period we could sense [a] general [inclination] of people to avoid these kinds of aerated drinks because they were never sure what they were consuming.”

The companies were not ultimately forced to make an exit, and as India’s bureaucracy swallowed the matter, public interest faded. Coca-Cola launched a PR offensive, and in Verma’s words, set to work in court “applying pressures through its power centres”.

Today, products from both companies are still widely available in the country and the cola moguls have put a lot of work into refreshing their image. On Coca-Cola’s India website, for example, the four most prominent menu buttons are: Environment & Society, Corporate Citizenship, Health & Wellness and Water Management.

But memories of the boycotts, bans and protests resonate among multinational corporations in India and beyond and offer a stark reminder of the risks to finance, brand and reputation posed merely by perceptions of irresponsible behaviour.

“You’re feathered and tarred. By the time you refute the allegations, the damage is done,” warns Jayant Bhuyan, CEO of the Indian Brand Equity Foundation and deputy director general of the Confederation of Indian Industry.

Cultivating a corporate consciousness

The legal consequences of corporate irresponsibility in India – even when potentially criminal – are often small. In spite of stringent laws in many areas, ineffectual enforcement means that the majority of offences remain undetected or unpunished. Furthermore, in common with many other developing markets, India’s regulations often allow multinationals to adopt looser standards of responsible behaviour than would be required of them in their home countries.

This is explained in part by the age of the modern Indian economy. Significant liberalizations to the slow-moving and socialist-leaning “licence raj” began only in 1991 so it’s no surprise that the concept of social responsibility is not yet embedded in the country’s corporate consciousness.

According to a November 2006 report by the United Nations Research Institute for Social Development, corporate social responsibility (CSR) has been practised and debated by business, industry associations, NGOs and the Indian government since the mid-1990s. However, the report notes that there is still much progress to be made: “CSR is not institutionalized as a part of business practice; instead it is more of a ‘social good’ left to the discretion of chief executive officers or top management.”

The UN report does conclude that CSR is on the rise in India, a view shared by many observers. Sampath, for example, believes that “corporate social responsibility is taking concrete shape, and while India is not yet a leader, it is certainly not a straggler.”

Verma too sees progress. He describes the evolving relationship between companies and society in India as a “slow transformation from a philanthropic coexistence to one where [the] mutual interest of all stakeholders is gaining paramount importance.

“The paradigm of corporate social responsibility in India has come a long way over the last few decades,” he says, “and has become the latest buzzword within the corporate arena.”

Global values

One reason for the progress is the increasing internationalization of Indian businesses. “The larger Indian companies have learned from their experiences in the UK, Europe, the United States and Canada,” says Richard Rogovin, a partner at US law firm Frost Brown Todd. They “are beginning to exercise corporate responsibility similar to larger companies outside India,” he adds.

This is particularly true for Indian companies that want to list on overseas exchanges. “If you’re doing that,” says Bhuyan, “you can’t have one entity meeting corporate responsibility parameters [overseas] and another sort of dodging it in India. You’ve got to be in sync and you’ve got to be in tune.”

Verma has observed an increasing number of Indian companies reporting social and environmental measures alongside their financial accounts. CSR is now an item on many corporations’ risk management agendas, he explains, and the Indian government is working to integrate the topic into the curriculum of the country’s business schools.

“Almost every large Indian company is progressively investing to improve its performance on sustainability parameters, fuelled by the belief that working for communities as a stakeholder in the business has a direct correlation with the business’s performance,” Verma says.

Indeed, as many as 50 large Indian companies now have formal machinery in place to undertake environmental development work and to build sustainable communities in their respective regions.

“A hundred years back you wouldn’t bother,” says Bhuyan. “Fifty years back you wouldn’t bother. Twentyfive years back you wouldn’t bother. But in today’s changed circumstances, you have to be absolutely conscious of that all the time.”

More equal than others

Of course, not all areas of corporate responsibility are equal in India. Or, at least, they don’t receive equal attention.

“Some of the areas that are more prominent than others are energy, education, training and employment,” notes Sampath.

Mysore Prasanna, group executive president and general counsel for the Aditya Birla Group, also highlights education and healthcare initiatives, areas in which government-run services are often inadequate. “Most corporates reach out to the local communities by providing them primary healthcare and primary education,” he says.

Mysore Prasanna, group executive president and general counsel for the Aditya Birla Group, also highlights education and healthcare initiatives, areas in which government-run services are often inadequate. “Most corporates reach out to the local communities by providing them primary healthcare and primary education,” he says.

Prasanna also points to the corporate adoption of environmental responsibility. “While the environment is seen as casting a statutory responsibility, it is nevertheless perceived by most responsible corporates as a corporate responsibility. These corporates take certain voluntary measures to ensure that the community around the workplace remains unaffected. There are also voluntary initiatives like rainwater harvesting and soil conservation.”

Verma says that corporate adoption of responsible environmental measures in India, like protecting the environment and conserving natural resources, were among the first and foremost concerns of large companies as corporate social responsibility began to catch on. But perhaps the bigger change has been the growth of corporate attention to labour issues.

“India being a welfare state, labour welfare was long considered to be a subject only the state was supposed to be concerned with,” Verma says. “However, with the rapid growth of privatization and corporatization, even corporates have begun to take an active role in adopting labour welfare-centric CSR strategies, [such as] building schools, hospitals, baby-care facilities for women employees, townships; providing an environment for lifelong learning for employees, employee empowerment and better information flow; improving the balance between work, family and leisure; diversified workforce; and profit-sharing and share ownership schemes.”

But not everyone paints such a rosy picture of the social responsibility exhibited by corporations in India. “Labour practices lag behind,” Rogovin says. “Environmental responsibility is also lacking in many cases. However, in most large companies fiscal responsibility is becoming a way of life and this is essential for successful growth, as it is perceived as not only necessary for infusions of capital, public and private, but also for debt financing.”

Financial accountability

Rogovin believes that “management has to be aware that a poor image as a reflection of irresponsible management practices will deter foreign investors who will perceive a greater risk to their capital.

Rogovin believes that “management has to be aware that a poor image as a reflection of irresponsible management practices will deter foreign investors who will perceive a greater risk to their capital.

“It is necessary for business leaders to recognize that a company’s image is part of its goodwill; an intangible asset that can boost its growth and earnings if properly addressed,” he says.

In order to avoid scenarios of irresponsibility quashing investment, Rogovin suggests that “Indian companies need to model themselves after companies in those countries from which they expect to attract investment.

“Prospective investors from more highly regulated countries need to feel comfortable with India’s business climate in general, and that climate is heavily influenced by the practices of large corporations.”

Tom Siebens, a partner at Milbank Tweed Hadley & McCloy, says such issues are particularly relevant to initial public offerings in India, on which he has worked for nearly two decades.

As the securities market has developed, the amount of regulatory attention it receives has increased markedly in scope and sophistication.

“A lot of corporate responsibility is really driven by what the regulators require,” Siebens says. “SEBI’s rules on board composition, independent board members and disclosure [forces] any private company into adopting some different practices.”

Noting that practices like insider trading and price-rigging lead to the destruction of wealth in the stock market, Verma applauds the fact that many “large companies are beginning to publish information that was once deemed to be sensitive”. However, he warns that while a growing number of companies are issuing robust performance measures, few of these statistics are independently verified.

In spite of this, Verma is optimistic: “The rapid rise of socially responsible investment illustrates that corporate citizenship is becoming a key measure that investors consider when aligning ethical concerns with publicly held corporations.”

Precautionary measures

In all areas of corporate responsibility – be it environmental, financial or welfare-related – the onus is on the corporation to be aware of the risks of irresponsible behaviour and to take precautions against potential hazards.

For instance, Verma says, a company involved in the handling or manufacture of hazardous industrial substances should take out a policy under the Public Liability Insurance Act, 1991, which seeks to provide immediate relief to those affected by any industrial accidents.

Sampath believes that foreign corporations doing business in India should be encouraged to maintain the same standards they would adhere to in their home nations and not have double standards in India. “Foreign companies need to ensure that they adhere to the strictest standards adopted in their own country, even if some of these standards are higher than required by law in India,” she says, adding that “this needs to be explained to Indian customers and publicized through PR and advertising”.

Sampath believes that foreign corporations doing business in India should be encouraged to maintain the same standards they would adhere to in their home nations and not have double standards in India. “Foreign companies need to ensure that they adhere to the strictest standards adopted in their own country, even if some of these standards are higher than required by law in India,” she says, adding that “this needs to be explained to Indian customers and publicized through PR and advertising”.

Risks can also be minimized by undertaking careful due diligence of any investment or company before getting involved. Verma recommends that corporates might even create a separate department for identifying and implementing the company’s responsibilities and risks in India.

But corporates should never count on advance planning, risk management or high profile gestures to the local community to get them out of trouble if and when it arises. “Just because generally the corporate has been more responsible, it will not be let off the hook,” warns Kothari. “They don’t really go soft on you because you build a hospital in the vicinity. If you stop polluting, you don’t need the hospital anyway.”

International liability

One area of considerable ambiguity is the degree to which foreign-based companies and corporate executives can be held accountable if charged with extreme negligence or malfeasance relating to environmental degradation, labour exploitation, industrial disasters or white-collar crime in India.

According to most legal experts, even in the worst case scenario of a neglect-enabled disaster, shareholders of a foreign corporation doing business in India are at risk of losing nothing more than their money.

Sampath warns that in certain cases of breach (under, say, the Factories Act), all directors will be held liable “unless the company identifies one director as being responsible for compliance on a specific legislation”.

However, according to Kothari, shareholders who are not on the board are not legally liable. “If you’re not in the management and control of the operation, and you’re not occupying a board seat, you only risk losing your capital,” he says.

While foreign shareholders can’t legally be held responsible for corporate negligence in India, Verma notes that foreign companies making a direct investment through joint ventures or subsidiaries most certainly can.

He explains that “the risks involved emerge only when the investee company is not following the requirements under the environmental, industrial, consumer and other appropriate legislations, or is in violation of the prescribed standards of health, safety and environmental measures.

“It is only in these cases that foreign investors may face legal and penal risks.”

Catch me if you can

Even in such cases, assessing the risk of possible prosecution is still something of a crystal ball-gazing exercise.

An increasing number of Indian companies are funding schools in their local communities.

As Kothari notes, India has strict laws that allow the criminal prosecution of a company’s managers and top stakeholders in cases of gross negligence. But how often are such laws implemented?

“Well, not so frequently,” Kothari concedes. “We have laws in place, but maybe at some point the bureaucracy could sometimes take over.”

“The most important aspect is strict enforcement, which has always been India’s weakness rather than strength,” says Priti Suri of Delhi-based law firm PSA. “Government action is needed to establish a framework which will provide for binding obligations.”

While gross negligence is often difficult to prove in court – even the worst industrial accidents can often be cast as a product of human error rather than malfeasance – Kothari thinks India’s enforcement problem is simpler. The only reason penalties are not awarded, he says, “is [due to a] lack of administration and lack of implementation of laws.”

As “the ideal case” to demonstrate India’s ineffectual enforcement of laws intended to clamp down on irresponsible corporate behaviour, Kothari points to the infamous Union Carbide disaster in Bhopal nearly 25 years ago, in which a powerful industrial chemical was released on hundreds of thousands of local residents, killing and maiming many.

“Nobody went to jail [for the Union Carbide disaster],” laments Kothari. “If it was any other country, the top management would be behind bars.”

“Nobody went to jail [for the Union Carbide disaster],” laments Kothari. “If it was any other country, the top management would be behind bars.”

Kothari doesn’t think the absence of punishment has much to do with the nationality of Union Carbide’s stakeholders (the majority of them were American, and the US refused to extradite them).

Other observers are less sure: “The influence of powerful economies cannot be underestimated,” says Suri. “Yet with increasing economic strength, India is now in a position to dictate as well. Rules are essentially the same for all nations, though it will not be wrong to say that reciprocity plays a role as well in framing the rules.”

Extradition remains a tough option if the accused aren’t in India, regardless of what their nationality is.

According to Verma, “except for serious legal liabilities, extradition is not envisaged in the framework of existing extradition treaties between India and different countries”.

The numbers, it seems, speak for themselves: “As of date, no foreigner has been indicted in any court of law for failure to comply” says Sampath.