Under the current economic and legal environment, in the normal operation and management of companies, compliance has been generally accepted and implemented as an important measurement for corporate governance. However, investment operators still do not pay enough attention to company liquidation compliance, and lack the necessary legal awareness of liquidation compliance.

Senior Partner

AllBright Law Offices

When the business purpose of a company is achieved, or the operating conditions are poor, the company is usually shelved or cancelled without legal liquidation. However, there are also compliance requirements in company liquidations.

In accordance with the Company Law and the Provisions of the Supreme People’s Court on Several Issues Concerning the Application of the Company Law of the People’s Republic of China (II) (Judicial Interpretation of Company Law II), shareholders of limited liability companies, directors and controlling shareholders of companies limited by shares, and actual controllers are the obligors of company liquidations, and they cannot be exempted from liquidation obligations on the grounds that they are not actual controllers, or do not actually participate in the operation and management of the companies.

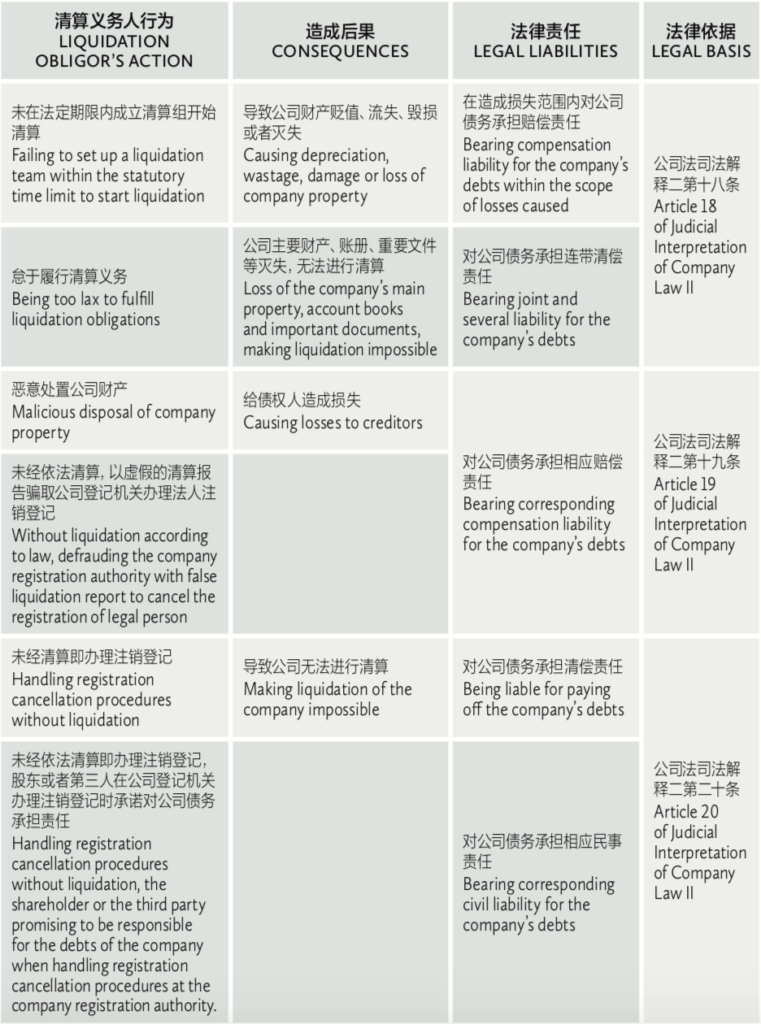

If the liquidation obligor fails to perform the liquidation obligation, resulting in corresponding consequences, it shall bear corresponding legal liabilities:

Partner

AllBright Law Offices

When the company and/or shareholders have liquidation demands, they can reasonably choose a liquidation path according to the specific situation of the company so as to achieve the purpose of compliant liquidation without increasing additional economic and legal burdens.

There are three paths for a company’s compliant liquidation – self-liquidation, compulsory liquidation and bankruptcy liquidation, among which self-liquidation and compulsory liquidation belong to the category of dissolution liquidation. The specific selection should be based on the actual situation of the company.

Company’s financial situation

When the company’s financial situation is normal, usually the assets are greater than or equal to liabilities, that is, when the owner’s equity is greater than or equal to zero, dissolution liquidation can be carried out. If the company’s financial situation is abnormal, and the debts due cannot be paid off, and the assets are insufficient to pay off all debts, or the company is obviously insolvent, bankruptcy liquidation shall be carried out according to law.

When determining the company’s financial situation, even if any shareholder’s capital contribution is not paid in, it should still be included in the company’s assets, and should be paid in during the actual liquidation process. If it is impossible to determine the company’s financial situation due to its perennial suspension of production and business, loss of account books, etc., dissolution liquidation can be carried out first. If the company is found to be insolvent in the liquidation process, the liquidation team shall apply to the people’s court for declaring it bankrupt according to law, and turn dissolution liquidation into bankruptcy liquidation.

Shareholder relationship

In the case of dissolution liquidation, if the company’s shareholder relationship is normal, an agreement can be reached on the company’s liquidation and the liquidation team is successfully formed to carry out compliant liquidation, then self-liquidation is applicable. If the company’s shareholder relationship is abnormal and it is impossible to form a resolution on the dissolution of the company and the establishment of a liquidation team, the shareholders and creditors may apply to the people’s court for compulsory liquidation of the company.

In the case of bankruptcy liquidation, if the company’s shareholder relationship is normal, a shareholders’ resolution can be made on the company’s application for bankruptcy liquidation as a debtor, thus starting bankruptcy liquidation. If the company’s shareholder relationship is abnormal and it is impossible to reach an agreement on the company’s application for bankruptcy liquidation as a debtor, but the shareholders who agree to bankruptcy liquidation also have outstanding claims on the company, then the shareholders can file bankruptcy liquidation application as creditors.

Xi Qing is a senior partner and Cai Meng is a partner at AllBright Law Offices

AllBright Law Offices

11/F and 12/F, Shanghai Tower

No. 501 Yincheng Middle Road

Pudong New Area, Shanghai 200120, China

Contact details:

Tel: +86 21 2051 1000

Fax: +86 21 2051 1999

Email:

Website: www.allbrightlaw.com