Most private equity (PE) funds are established in the form of a limited partnership. The general partner (GP) manages fund matters and bears unlimited joint and several liability for the debts of the fund; and the limited partners (LPs), as investors of the fund, do not participate in the fund’s management, and bear limited liability only to the extent of their amount of contributions. This column takes a brief look at the evolution of the structure of funds since the broad acceptance of the limited partnership model in China.

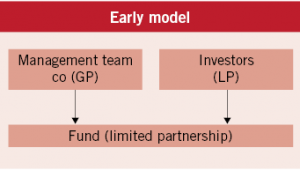

Early model. The basic structure commonly used for limited partnership funds at the outset was the establishment of a limited liability company by the managing person and his team members as shareholders (the management team company), which then, acting as the GP, initiates and establishes a limited partnership fund.

Early model. The basic structure commonly used for limited partnership funds at the outset was the establishment of a limited liability company by the managing person and his team members as shareholders (the management team company), which then, acting as the GP, initiates and establishes a limited partnership fund.

The GP may serve as the fund’s management company, or alternatively a separate limited liability company may be established to be the management company after the execution of a management agreement with the fund. In order to simplify the discussion, the author will assume that the GP also serves as the management company as well.

You must be a

subscribersubscribersubscribersubscriber

to read this content, please

subscribesubscribesubscribesubscribe

today.

For group subscribers, please click here to access.

Interested in group subscription? Please contact us.

你需要登录去解锁本文内容。欢迎注册账号。如果想阅读月刊所有文章,欢迎成为我们的订阅会员成为我们的订阅会员。

北京市朝阳区东三环中路7号

北京财富中心写字楼A座4201室

邮编100020

Suite 4201, Building A, Fortune Plaza Office Tower

7 East 3rd Ring Middle Road

Chaoyang District, Beijing 100020 China

电话 Tel: +86 10 6530 9989

传真 Fax: +86 10 6530 9980

电子信箱 E-mail:

mjin@pacgatelaw.com

www.pacgatelaw.com